The most realistic

paper trading platform

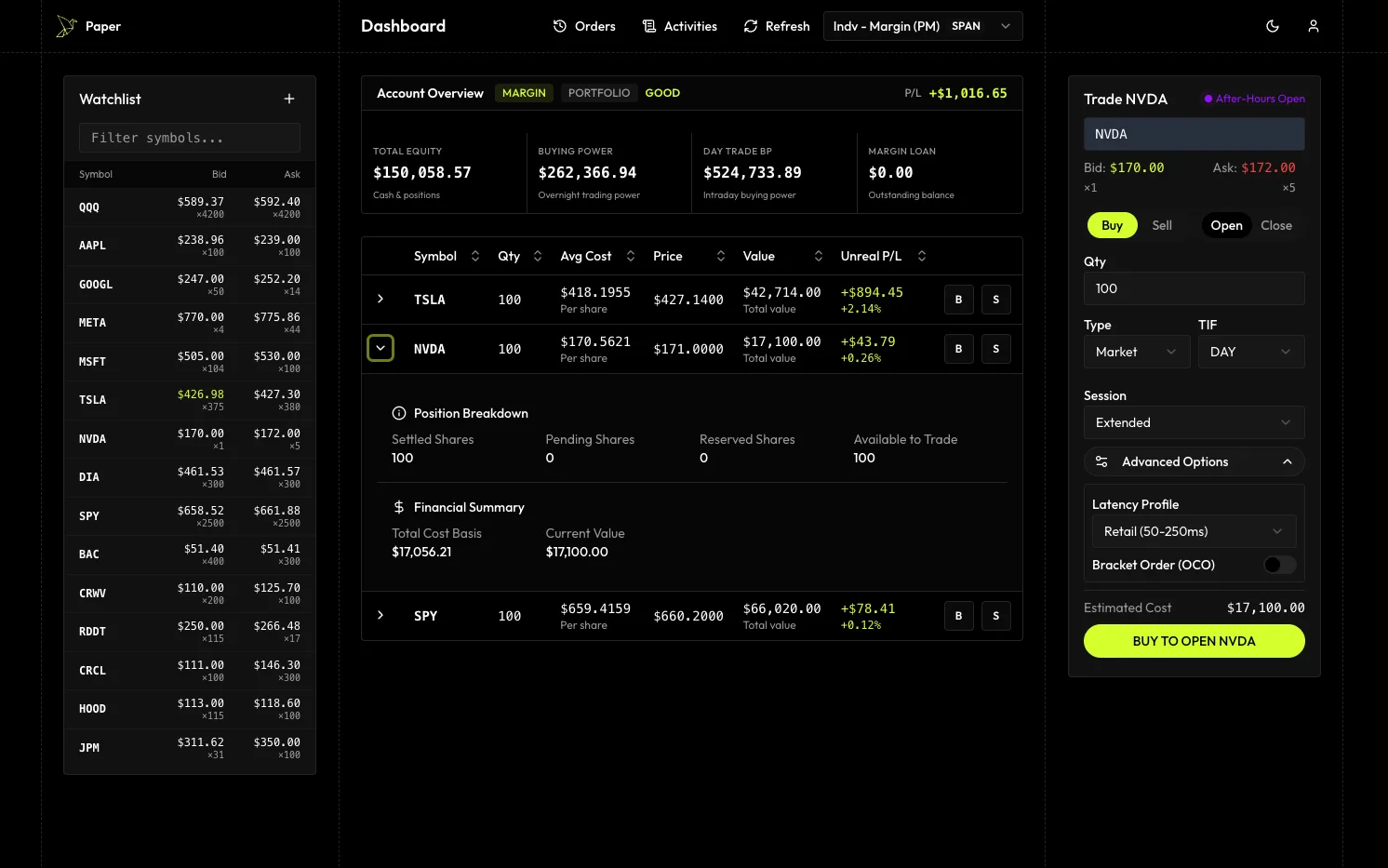

Experience real slippage, partial fills, and market impact. Test drive 22 different brokers with their exact rules, all in one platform. Practice with the friction you'll face with real money.

The hidden cost of unrealistic practice

When you transition from paper trading to real money, the shock can be devastating. Strategies that worked perfectly in simulation suddenly fail because they never accounted for the messy reality of actual markets.

Fantasy Paper Trading

What most platforms show you

"This trading thing is easy!"

Paper Reality

What actually happens in real markets

"Why didn't anyone warn me?"

Paper shows you what trading actually feels like - with all the friction, slippage, and market realities that other platforms ignore.

Built for realistic trading simulation

Every feature designed to mirror real market conditions and prepare you for actual trading. Experience the chaos, complexity, and nuance of real markets without risking a single dollar.

Real-Time Execution Engine

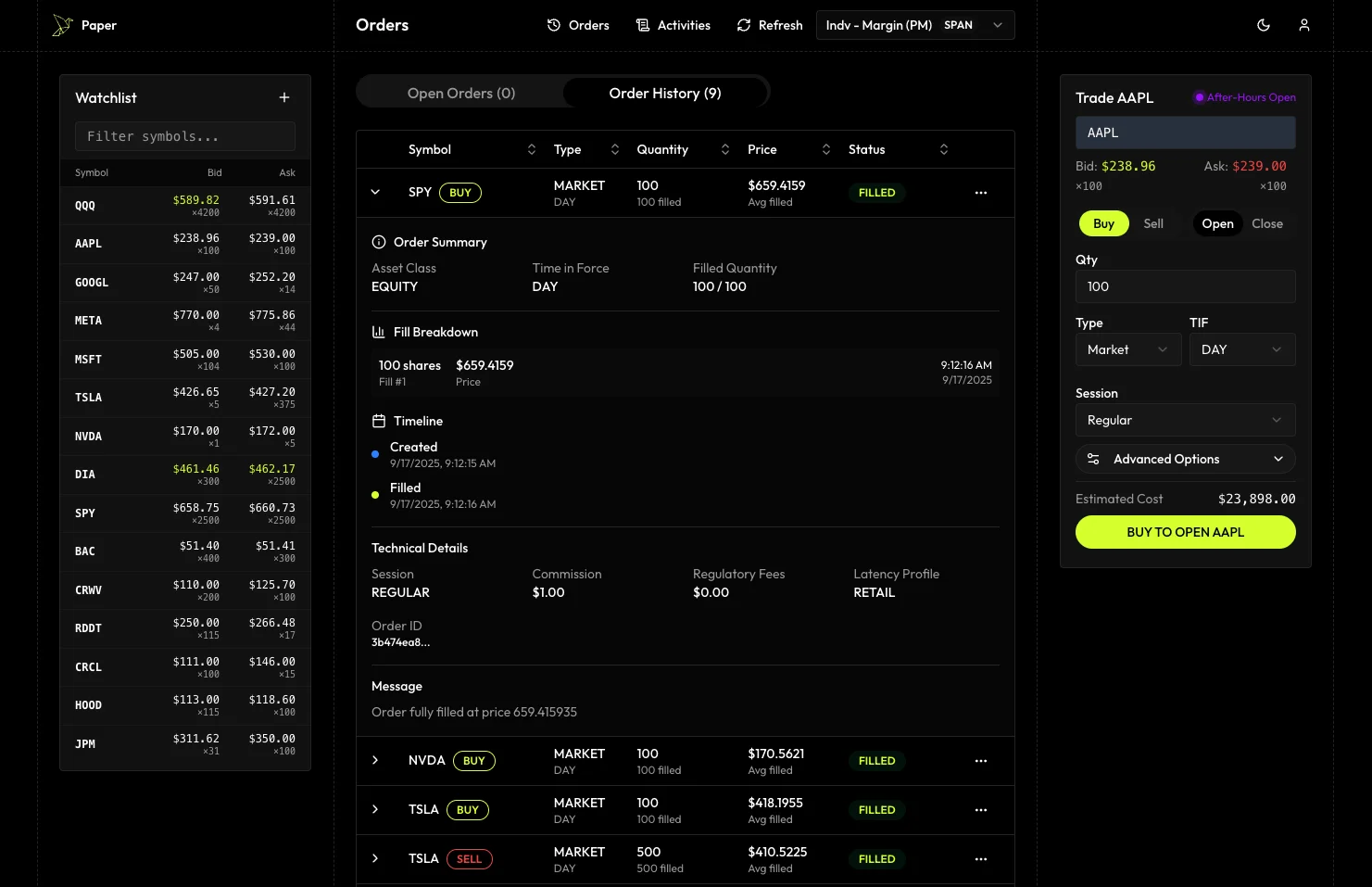

Matching logic based on NBBO, order type, and time priority. Experience realistic fills, not instant perfection. Access via API.

Simulated Market Latency

Add realistic network delays. Test your strategies under different conditions, from retail to HFT scenarios.

Partial Fills & Slippage

Large orders get partial fills based on liquidity. Experience real slippage and price impact modeling.

Market Events & Halts

Trade through halts, circuit breakers, and auction periods. Learn to navigate real market conditions.

Real Margin & Fees

Full margin simulation with interest, calls, and liquidations. Accurate fee modeling including SEC, FINRA, and exchange fees. Learn more.

Real P&L Tracking

Track your realized and unrealized gains with accurate cost basis calculations. See your true performance without the complexity of tax implications.

For Developers

Build with our paper trading API. Real-time quotes, realistic fills, and quickstarts for Python and Node.

MCP Integration

Connect Cursor/Claude to Paper via MCP to fetch quotes and place paper orders.

Paper Trading API (REST + SSE)

Endpoints to place orders, stream portfolios, and fetch quotes.

WebSocket Quotes

Subscribe to real-time market data with WebSockets.

Paper Trading API for Python

Copy-paste Python examples for auth, orders, and streaming.

Paper Trading API for Node.js

Node 18+ fetch and WebSocket quickstarts for bots and dashboards.

Test drive 22 different brokers

before you commit

Paper is the only platform that accurately emulates the exact trading rules, restrictions, and behaviors of major brokers. Compare commissions, margin requirements, trading hours, and order types across brokers to find your perfect match.

Live Broker Comparison

Why broker emulation matters

Experience exact commission structures including per-share pricing, option contract fees, and broker-specific caps

Fidelity starts pre-market at 7am while IBKR starts at 4am - test how this impacts your strategy

Robinhood doesn't allow short selling, Vanguard has no extended hours - know before you go

Test portfolio margin at Schwab, IRA match bonuses at Robinhood, or cash-only at Public

All 22 brokers, perfectly emulated

Switch between brokers instantly. Test your strategies across different platforms.

More brokers coming soon

Advanced features the pros actually use

Go beyond basic orders. Paper supports the full spectrum of professional trading strategies and risk management tools you'll find at any major brokerage. Perfect for Pro traders.

Portfolio Margin

Test strategies with professional margin models before risking real capital.

Advanced Order Types

Execute sophisticated strategies with institutional-grade order types.

- •Trailing Stop Orders - Dynamic risk management

- •Bracket Orders - Automated profit & loss targets

- •FOK & IOC - Fill-or-Kill, Immediate-or-Cancel

- •Extended Hours - Pre-market & after-hours trading

See it in action

SIMPLE Risk Engine

Basic shock-based calculation

Bracket Order Entry

Complete risk management strategy

Trade with AI agents using natural language

Paper is the first trading platform with Model Context Protocol (MCP) integration. Let AI assistants like Claude execute trades, manage portfolios, and analyze markets through simple conversations. Test the future of AI-driven investing in a risk-free environment.

"Buy 100 shares of Apple and set a stop loss at 5% below the current price"

"I'll place that order for you. Current AAPL price is $178.50..."

Stop Loss set: $169.58 (-5%)

"Show me the best performing sectors in my portfolio"

"I've analyzed your positions by sector. Technology is up 15.2%..."

Revolutionary AI Trading Features

- ✓Natural Language Trading

Describe complex strategies in plain English

- ✓Autonomous Execution

AI agents can place, modify, and cancel orders

- ✓Portfolio Intelligence

Get AI-powered insights on positions and performance

- ✓Risk-Free Testing

Perfect environment to test AI trading strategies

Learn more about AI paper trading with MCP →

Perfect for beginners learning to trade

Start your trading journey in a safe, realistic environment. Learn market mechanics, test strategies, and build confidence without risking real money.

Why beginners choose Paper for paper trading

Begin with 5 free trades daily. Perfect for learning basics without any financial commitment.

Experience slippage, fees, partial fills, and PDT rules now, not when real money is on the line.

Try all 22 broker interfaces to find the one that fits your trading style.

Use natural language to place trades and get insights. Perfect for beginners.

Beginner-friendly features

- ✓Simple market and limit orders to start

- ✓Real-time P&L tracking shows your progress

- ✓PDT rules enforced - learn proper risk management

- ✓Cash account simulation - no margin complexity

- ✓Mobile-friendly interface for trading anywhere

- ✓API access to build your own tools

Pro tip: Start with our free tier to learn the basics, then upgrade to Pro when you're ready for advanced features like extended hours and margin trading.

Build on Paper's infrastructure

Access the same realistic trading engine through our paper trading API. Perfect for building trading bots, testing algorithms, or integrating paper trading into your platform. Free tier available.

- ✓REST API

Place orders, manage portfolios, access market data

- ✓SSE Streaming

Real-time order and portfolio updates via Server-Sent Events

- ✓MCP Protocol

Enable AI agents to trade on your behalf

- ○Native SDKsComing Soon

Python, JavaScript, and Go client libraries

Learn more about our paper trading API →

// Place a realistic market order

const API_KEY = 'your_api_key';

const response = await fetch('/api/oms/orders', {

method: 'POST',

headers: {

'X-API-Key': API_KEY,

'Content-Type': 'application/json'

},

body: JSON.stringify({

customerId: '550e8400-e29b-41d4-a716-446655440000',

portfolioId: '660e8400-e29b-41d4-a716-446655440001',

assetClass: 'EQUITY',

symbol: 'AAPL',

side: 'BUY_TO_OPEN',

quantity: 100,

type: 'MARKET',

timeInForce: 'DAY',

latencyProfile: 'COLOCATED'

})

});

const order = await response.json();

console.log('Filled at: $' + order.averageFilledPrice);

console.log('Slippage: ' + (order.executionQuality?.averageSlippagePercent ?? 'N/A') + '%');